The Tea on Student Loan Forgiveness

Alright, so here’s the rundown on the Student Loan Forgiveness or Public Service Loan Forgiveness (PSLF) program and how you qualify and what changes have been made that benefit us.🏫💸

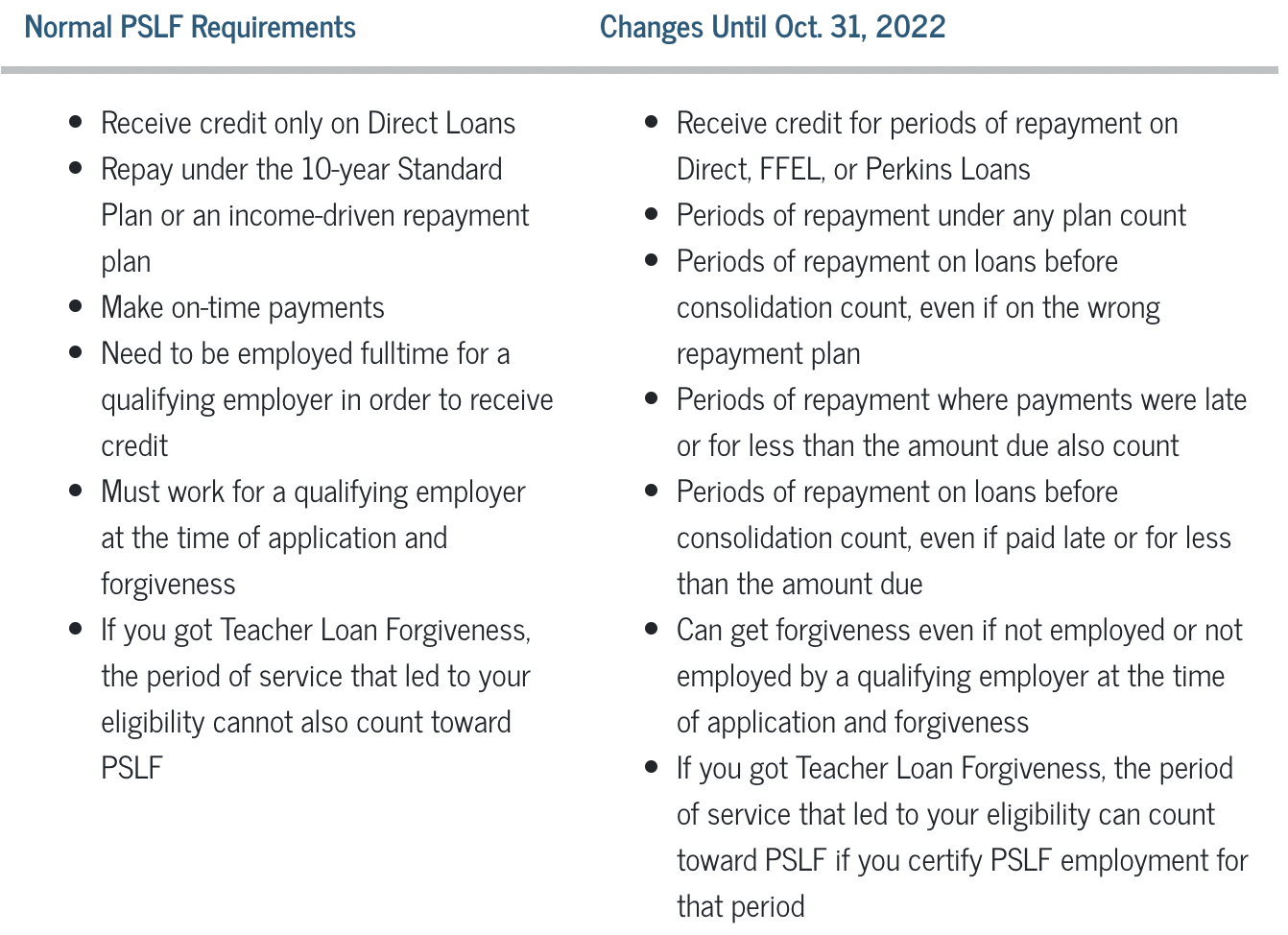

The goal in applying now, is to determine how many qualifying payments you have made, as you still have to make 120 payments to qualify for loan forgiveness. They have temporarily relaxed the eligibility rules as part of the COVID—19 emergency relief, which means payments that would not have counted before, may be counted now.

SWIPE →for all the deets below and READ the information below. For more details and information visit StudentAid.gov/PSLF.

Deadline to take advantage of the NEW program rules is: October 31, 2022. Don’t wait until last minute because it can take time to gather your information and get your signatures.‼️⏰

1. The requirements are the same as before, you must get to 120 qualified payments before your remaining loan balance can be forgiven.

2. You must work for a qualified employer. These employers include, U.S. federal, state or local government agencies, federal military service, public safety, law enforcement, public education, public health, such as nurses and nurse practitioners. You will need your employer’s EIN number to verify if they are qualified. You can get that from your W2s.

3. You had to have already made payments while employed full time at a qualified employer. Your loans are only forgiven after 120 payments have been made.

4. Only Direct Loans that are not in default may be forgiven. If you have Federal Family Education Loan (FFEL) Program loans, Federal Perkins Loans, or other types of federal student loans that are not Direct Loans (for example, those from older loan programs, such as Federally Insured Student Loans (FISL) or National Defense Student Loans (NDSL), you must consolidate those loans into the Direct Loan program by Oct. 31, 2022. But be sure you are aware of your loan type and payment plan before you consolidate, because once you consolidate you can’t reverse it. You can check your loan type at StudentAid.gov by logging in.

5. Here’s the steps you need to take to apply:

-First, read about the program at StudentAid.gov/PSLF

-Gather the EIN numbers from all your qualified employers. (Located on your W2s)

-Use the PSLF Help Tool on StudentAid.gov/PSLF to check if your employers qualify.

-Find who at your current and previous employer(s) need to sign your form. This may take some time, so start NOW! Remember, you need to submit an application for each employer.

-Verify what type of loans you have, they must be Direct Loans or you have to consolidate your loans. Refer to #4.

-Download the PSLF application and fill out page 1, your employer will fill out and sign page 2. Be careful with your signatures, see below acceptable forms of signatures.

-Once you have a completed application from all your employers (remember you need a separate form from each employer), submit the application(s).

-You can submit the application(s) online if you have MOHELA as your servicer. If your loan isn’t serviced by MOHELA, you must mail or fax your application. If you’re mailing it, I would suggest sending it certified mail, so you can get a tracking number and track it. Details to send below.

Return the completed form and any documentation to:

Mail to: U.S. Department of Education, MOHELA, 633 Spirit Drive, Chesterfield, MO 63005-1243.

Fax to: 866-222-7060

Upload to: mohela.com/uploadDocument, if MOHELA is already your servicer.

Again, don’t wait until last minute. Be patient, there are a lot of applications coming in. Turnaround time to receive a determination is 30-60 days and may be more.🥴

Summary of Changes